Summarize at:

MetaTrader is a popular trading platform used by many traders around the world. It helps traders analyze financial markets and execute trades. However, some people find MetaTrader has limitations. These include usability issues, limited backtesting features, and problems running it on Mac computers. Because of these issues, traders often look for a MetaTrader alternative.

MetaTrader 5 (MT5) offers real-time trading, technical analysis, and automated trading with expert advisors (EAs). But some users feel that MT5 is not user-friendly enough and lacks certain features they need. This leads them to search for MT5 alternatives that provide a better trading experience.

In this article, we will look at several MetaTrader alternatives. These include:

- Forex Tester Online (FTO);

- TradingView;

- eToro;

- NinjaTrader;

- Active Trader Pro;

- Thinkorswim

We will explain the key features and benefits of each platform.

Why People Are Looking for MetaTrader Alternatives for Backtesting

Limitations of MetaTrader

Many traders look for MetaTrader alternatives because of its limitations. MetaTrader is great for trading, but some find it lacking as a backtesting tool. This makes them seek out other metatrader backtesting software.

Usability Issues

MetaTrader 5 (MT5) can be hard to use for some traders. The interface is not always user-friendly. This can make it tough for beginners to backtest in MT5. They often look for simpler platforms.

Limitations of MetaTrader for Backtesting

Many traders look for MetaTrader alternatives because of its critical backtesting limitations which is crucial for strategy refinement. MT4 and MT5 offer limited historical data, with quality concerns especially in tick data representation. The backtesting engine struggles to simulate real market conditions accurately, with MT4 further restricted to testing only one currency pair at a time. While MT5 handles EA backtesting adequately for single strategies, it cannot backtest multiple EAs simultaneously—a significant drawback for portfolio traders.

Performance issues arise with large datasets, and the manual backtesting experience lacks intuitive controls and efficient navigation to specific market conditions. These shortcomings make dedicated backtesting tools increasingly attractive to serious traders.

Compatibility Problems

Running MetaTrader on a Mac can be tricky. Many traders face compatibility problems with MT5. They look for MT5 backtesting software that works better on their devices.

Better Options Available

There are many apps like MetaTrader that offer better trading experience or more backtesting features. This doesn’t mean that you should leave MetaTrader, but you can use several tools at the same time. This will make your trading more rational and rational.

8 Best Metatrader Alternatives in 2025

In this section, we will explore some of the best MetaTrader alternatives.

1. Forex Tester Online

Forex Tester Online (FTO) has emerged as the premier dedicated backtesting platform, designed specifically for strategy development and optimization rather than live trading. While MetaTrader attempts to serve both purposes, FTO excels by focusing exclusively on creating the most powerful backtesting environment possible.

What Makes FTO Superior for Backtesting

Advanced Tick-by-Tick Testing

FTO delivers true historical tick data simulation, not the synthesized ticks found in MT4. This creates a precise market replay that accurately represents how markets actually moved historically. The platform supports testing across more than 200 instruments including Forex, Crypto, Stocks, Indices, and ETFs, giving traders access to up to 21 years of high-quality historical data for comprehensive strategy validation.

Unmatched Testing Efficiency

Where FTO truly shines is its comprehensive navigation system. Traders can instantly jump to specific price levels, technical indicator crossings, drawing tool intersections, historical economic events, or trading sessions. This intelligent navigation allows traders to test years of data in hours rather than days with optimized performance. Many users report that the jump-to functionality reduces analysis time by up to 50%, eliminating the tedious scrolling through irrelevant data that plagues MT platforms.

Multi-Chart & Multi-Timeframe Analysis

FTO solves one of the most frustrating limitations of MT platforms by allowing traders to simultaneously run up to 8 charts with different symbols and timeframes. These charts remain perfectly synchronized when moving through historical data, but each can display unique indicators and drawing tools. Unlike MT5, which struggles with multi-timeframe analysis, FTO handles this complex task seamlessly, making it significantly easier to develop sophisticated strategies that rely on multiple timeframes.

Upcoming EA Backtesting Capabilities

The forthcoming FTO release will introduce custom EA backtesting with advanced analytics to refine automated strategies. This update will include multi-EA testing capabilities and seamless multi-timeframe analysis for complex algorithms. The intuitive interface works flawlessly on Mac without requiring any workarounds—a significant advantage over MT platforms.

A standout feature of FTO is its ability to create custom backtesting environments that match specific prop firm rules. Traders can define profit targets, maximum drawdown limits, and trading day requirements, then practice without financial risk before committing to paid challenges. The system provides real-time feedback on performance metrics relative to challenge parameters, helping traders refine their approaches to meet specific firm requirements.

Automation and Trading Tools

FTO improves testing efficiency through automation features that can set conditional reactions based on price, time, or session events. The platform allows direct chart trading with intuitive order placement and drag-and-drop order level adjustments. Position management features include partial close, double position, and reverse position options, complemented by advanced risk management with flexible lot sizing and stop-loss/take-profit settings in currency or percentage terms.

Browser-Based Accessibility

Perhaps the most practical advantage of FTO is that it requires no downloads or installations. The platform works on any device including Mac, Windows, Linux, iOS, and Android with no need for virtual machines or compatibility workarounds. The intuitive user interface presents a minimal learning curve compared to MT platforms, allowing traders to focus on strategy development rather than fighting with the software.

| Feature | Forex Tester Online | MT5 |

|---|---|---|

| Platform Focus | Dedicated backtesting | General trading platform |

| Manual Backtesting | Advanced with comprehensive controls | Basic with limited flexibility |

| Historical Data Quality | High-quality tick data included | Limited without additional purchases |

| Multi-Symbol Testing | Up to 8 charts simultaneously | Limited by system resources |

| Navigation Efficiency | Jump to specific conditions instantly | Manual scrolling through history |

| Mac Compatibility | Native browser support | Requires workarounds |

| Prop Firm Simulation | Built-in with customization | Not available |

| EA Testing | Coming soon with superior analytics | Available but with limitations |

| Performance Tracking | Comprehensive analytics | Basic statistics |

| Pricing Model | One-time purchase, lifetime access available | Free platform, but limited functionality |

Forex Tester Online represents a specialized solution for traders who understand that proper backtesting is the foundation of trading success. While MT platforms attempt to be all-in-one solutions, FTO excels by focusing exclusively on creating the most powerful and efficient backtesting environment possible.

FTO stands out as a powerful addition to MetaTrader when it comes to testing Forex strategies. Do backtesting on Forex Tester Online — and execute trades on Meta Trader. This would be a great tandem.

Now let’s move on to other MT5 alternatives.

2. TradingView

TradingView is a powerful platform favored by many traders for its advanced charting capabilities and social trading features. Unlike MetaTrader, which is primarily a downloadable application, TradingView operates entirely through the web. This allows for seamless access across different devices and operating systems, making it highly convenient for traders who need flexibility.

TradingView vs Meta Trader 5

User Interface

TradingView’s interface is modern and intuitive, making it easy for beginners to start. MetaTrader’s interface, while comprehensive, can appear outdated and more complex, posing a steep learning curve for new users.

Community and Social Features

TradingView excels in its social trading capabilities. Users can follow other traders, share insights, and discuss strategies, fostering a collaborative environment. MetaTrader lacks this social aspect, making TradingView superior for traders who value community interaction.

Backtesting and Strategy Testing

Both platforms offer backtesting features, but TradingView integrates it more smoothly with its Pine Script. This allows traders to quickly develop and test strategies directly within the platform. MetaTrader 5’s strategy tester, although powerful, is more cumbersome and less user-friendly, often requiring more technical knowledge to operate effectively.

TradingView is frequently praised in reviews for its advanced charting capabilities and user-friendly interface. Experts highlight the platform’s ability to cater to both beginners and advanced traders, thanks to its customizable features and extensive market data. The social trading aspect is often cited as a major advantage, providing a collaborative environment that enhances the trading experience.

In contrast, MetaTrader is often recommended for its trading capabilities and widespread use among forex traders. However, reviews often mention its steep learning curve and the need for additional software to access its full potential.

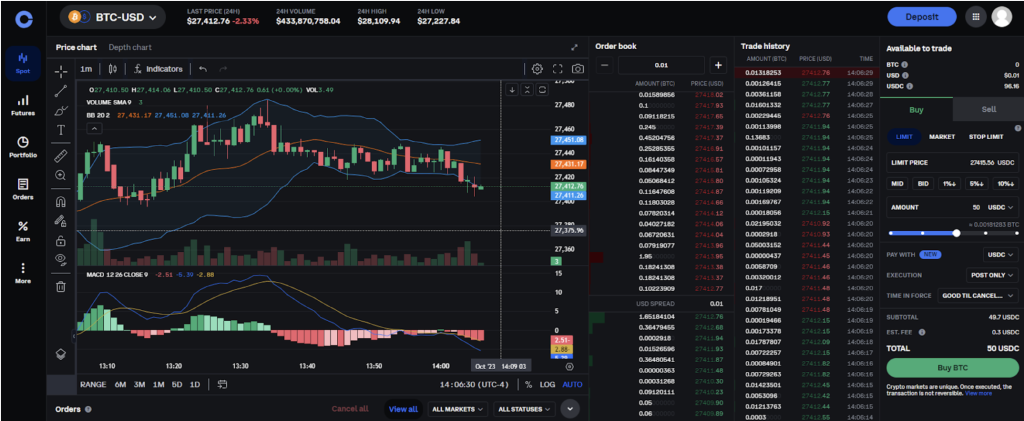

3. eToro

eToro is a well-known trading platform that has gained popularity for its unique social trading features. Unlike MetaTrader, which is primarily focused on providing advanced technical analysis tools and automated trading capabilities, eToro emphasizes a more social approach to trading. This makes eToro a distinctive MetaTrader alternative for those interested in community-driven trading experiences.

How eToro Compares to MetaTrader

Social Trading vs. Technical Analysis

eToro’s strength lies in its social trading features, allowing users to copy trades and engage with a community of traders. MetaTrader, on the other hand, excels in providing advanced technical analysis tools and automated trading via expert advisors (EAs). Traders looking for in-depth analysis and automation might find MetaTrader more suitable.

Ease of Use

eToro offers a more user-friendly experience with its clean and intuitive interface. MetaTrader, while powerful, has a steeper learning curve and can be overwhelming for beginners. eToro’s straightforward design is more accessible for new traders.

Asset Diversity

eToro offers a broader range of asset classes, including stocks and cryptocurrencies, alongside traditional forex trading. MetaTrader primarily focuses on forex and CFDs, which might limit traders looking to invest in a more diverse portfolio.

Community and Education

eToro’s social trading and educational resources provide a supportive environment for traders. MetaTrader lacks these social features, making it more isolated in comparison. eToro’s community-driven approach can be particularly beneficial for those who prefer learning through interaction and observation.

eToro is a strong MetaTrader alternative, especially for traders who value social trading and a user-friendly interface. Its diverse asset classes and supportive community make it an excellent choice for beginners and those looking to diversify their investments. However, for traders who need advanced technical analysis tools and automated trading capabilities, MetaTrader remains the better option.

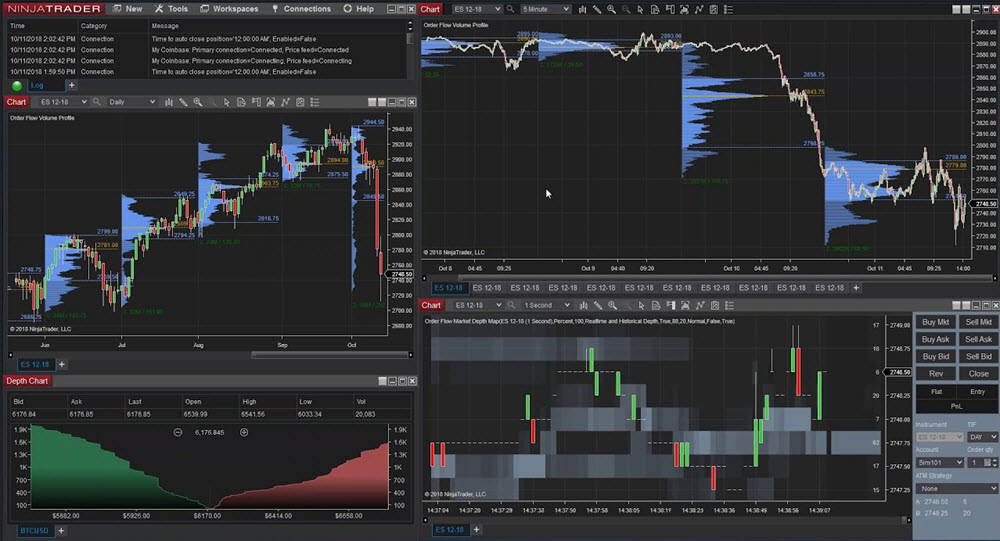

4. NinjaTrader

NinjaTrader is a well-established trading platform designed for advanced traders who need comprehensive charting, analysis, and automated trading capabilities. It is a strong MetaTrader alternative, particularly for those looking for a more customizable and feature-rich trading experience.

Key Features and Benefits

NinjaTrader offers several advanced features that set it apart:

Advanced Charting

NinjaTrader provides highly customizable charting options with a vast array of technical indicators. The platform’s advanced charting capabilities are considered superior to those of MetaTrader, offering more flexibility and detail.

Strategy Development and Automation

NinjaTrader excels in strategy development and automated trading. It allows traders to build, backtest, and deploy automated trading strategies using its powerful NinjaScript programming language. This is similar to MetaTrader’s expert advisors (EAs) but offers more customization.

Market Data and Analysis

NinjaTrader provides access to a wide range of market data, including real-time and historical data. Its market replay feature allows traders to simulate trading in a real-time environment, which is a unique benefit not fully matched by MetaTrader.

Order Execution and Management

NinjaTrader offers advanced order execution and management tools, including advanced order types and trade management capabilities. This provides greater control over trades compared to MetaTrader.

How NinjaTrader Compares to MetaTrader

NinjaTrader’s customization options for charts and indicators are more extensive than MetaTrader’s. Traders who need highly specific and detailed analysis tools may find NinjaTrader more suitable.

Both platforms support automated trading, but NinjaTrader’s NinjaScript offers more flexibility and power than MetaTrader’s MQL language. NinjaTrader’s strategy testing and backtesting features are also more integrated and user-friendly.

To sum up, NinjaTrader is a strong MetaTrader alternative for advanced traders. It offers a lot of customization, advanced charting, and powerful automation tools. While MetaTrader is still a good choice, NinjaTrader’s flexibility and unique features, like market replay, make it great for those wanting a more advanced platform. Choosing between the two depends on what you need and how experienced you are.

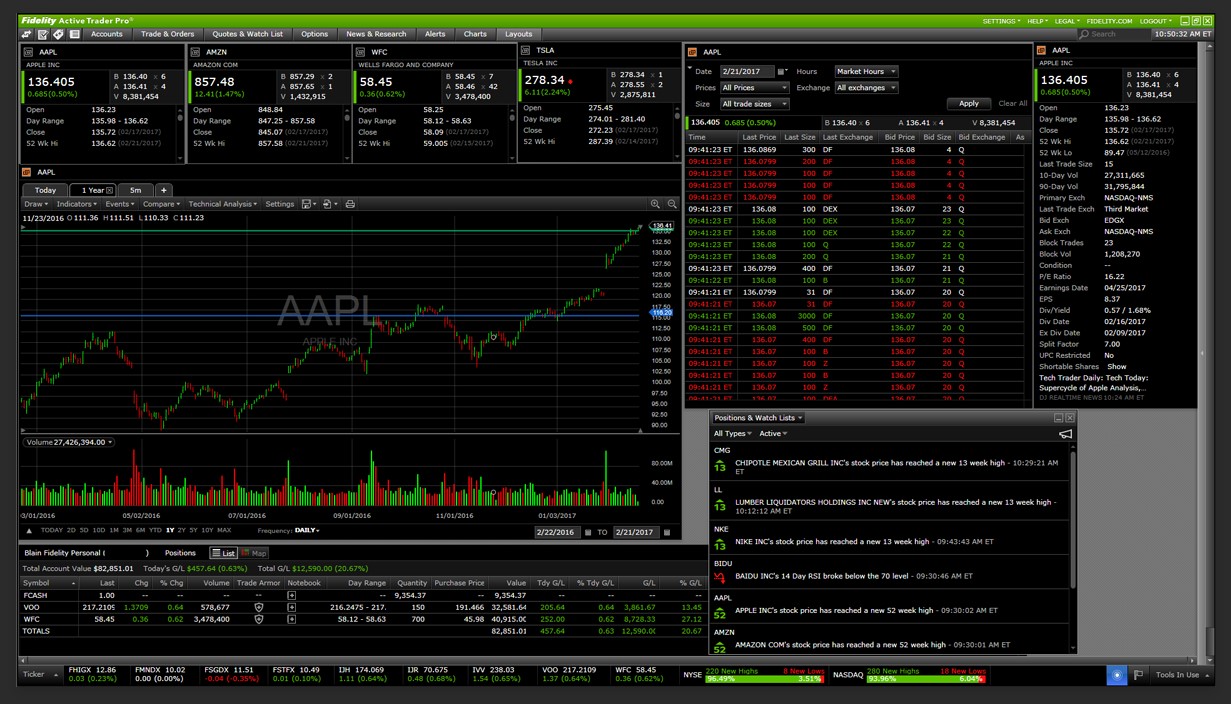

5. Active Trader Pro

Active Trader Pro is a trading platform offered by Fidelity, designed for active traders who need real-time data and advanced trading tools. It is a strong MetaTrader competitor, especially for traders who want a robust platform backed by a major brokerage.

How Active Trader Pro Compares to MetaTrader

How Active Trader Pro Compares to MetaTrader

Broker Integration

Active Trader Pro is directly integrated with Fidelity’s brokerage services, offering seamless account management and trading. MetaTrader requires choosing a compatible broker, which can add an extra step.

User Interface

Active Trader Pro’s interface is user-friendly and designed for quick access to important tools. MetaTrader’s interface, while powerful, can be more complex and intimidating for beginners.

Data and Research

Active Trader Pro provides comprehensive research tools and real-time data directly within the platform. MetaTrader also offers real-time data but relies more on third-party plugins for in-depth research.

Active Trader Pro is a strong MetaTrader alternative, especially for those already using Fidelity. It offers real-time data, advanced charting, and extensive research tools. While MetaTrader is powerful and flexible, Active Trader Pro’s user-friendly design and direct integration with Fidelity make it a great option for active traders.

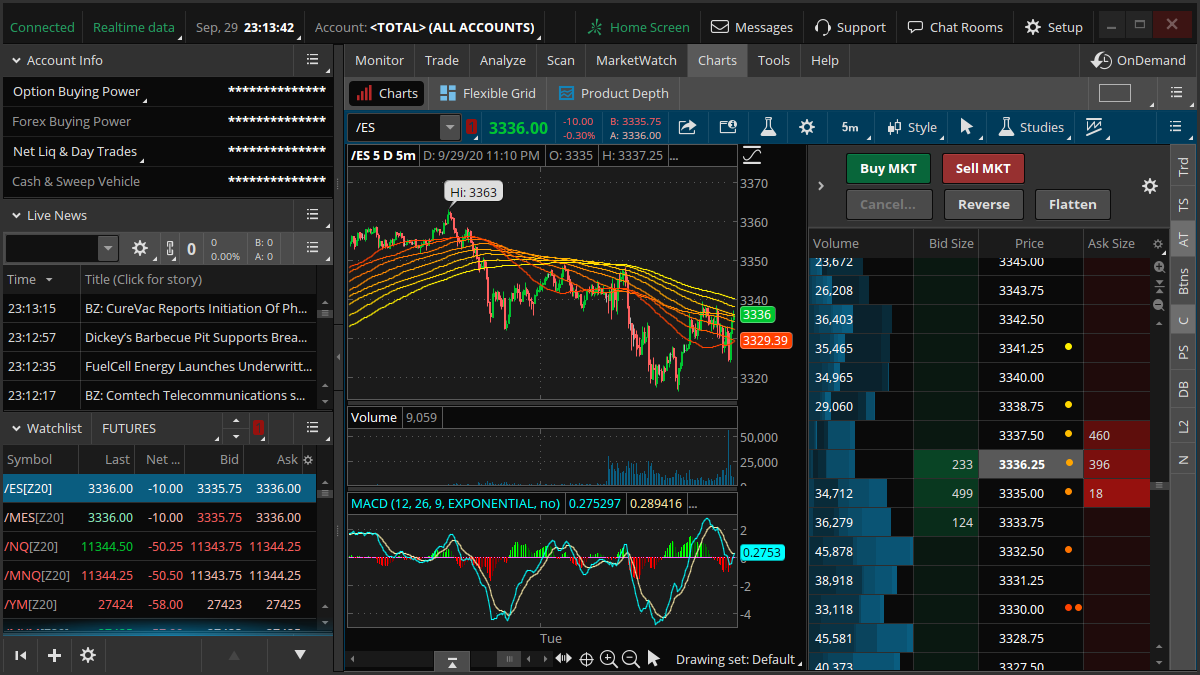

6. Thinkorswim

Thinkorswim is a trading platform provided by TD Ameritrade, designed for advanced traders who need comprehensive tools for trading and analysis. It is considered a strong MetaTrader competitor due to its robust features and integrated brokerage services.

Final Recommendations

When choosing the right platform for your trading needs, consider how you’ll use it in your overall trading workflow:

For Strategy Development and Backtesting: Forex Tester Online (FTO) stands out as the clear leader for serious backtesting and strategy refinement. Its dedicated focus on creating the most comprehensive testing environment delivers superior efficiency and accuracy that general trading platforms simply can’t match. The platform’s specialized navigation tools, multi-chart capabilities, and upcoming EA testing features make it the ideal environment for developing robust strategies before risking real capital.

Most successful traders use FTO to develop, test, and optimize their strategies thoroughly before deploying them in live markets. This preparation phase is crucial—the more realistic your backtesting, the more confidence you’ll have when trading with real money.

For Live Trading: While FTO excels at backtesting, it’s designed specifically for strategy development rather than execution. Many traders continue using MetaTrader or another live trading platform for actual market execution after developing their strategies in FTO. This combination gives you the best of both worlds: specialized tools for strategy development and familiar platforms for execution.

For Traders Seeking an All-in-One Solution: Some traders prefer the convenience of platforms like TradingView or NinjaTrader which offer both analysis and trading capabilities in a single package. While this approach has its merits for certain trading styles, it’s important to recognize that these platforms won’t match the dedicated backtesting capabilities of specialized tools.

The most successful traders often maintain a clear separation between their strategy development environment and their execution platform. They understand that using the right tool for each specific purpose in their trading workflow yields better results than trying to find a single platform that does everything adequately but nothing exceptionally well.

Other Useful MetaTrader Alternatives

1. For Brokers

- B2TRADER

- Trader Workstation

- Match-Trader

- TradeLocker

- XOH Trader

- WOW Trader

- Quadcode Trading

2. Best for ECN Trading: cTrader

3. Best for Research and Education: E*Trade Web Platform

Summary of Metatrader competitors

If you’re looking for a MetaTrader backtesting alternative to strengthen your trading toolkit, consider these specialized options:

For Dedicated Backtesting:

Forex Tester Online (FTO): The premier browser-based platform with advanced navigation, multi-chart analysis, and prop challenge simulation. Ideal for traders who want convenience without sacrificing professional features.

Both platforms significantly outperform MetaTrader’s backtesting capabilities and represent worthwhile investments for serious traders.

For General Trading Platforms with Better Features:

- TradingView: Excellent for robust charting and social trading. Great for community insights and collaboration.

- eToro: Known for social trading features, allowing trade copying. Ideal for those preferring a community-driven approach.

- NinjaTrader: Offers extensive customization and advanced automation. Suited for experienced traders needing sophisticated tools.

- Active Trader Pro: Provides real-time data and integrated brokerage services. Best for active traders with a user-friendly interface.

- Thinkorswim: Advanced charting and integrated research. Great for traders valuing broker integration.

Each platform has unique strengths that cater to different trading styles and requirements. We hope this article has helped you identify which alternative best suits your specific trading needs

FAQ

What is MetaTrader?

MetaTrader is a popular trading platform used for analyzing financial markets and executing trades. It offers tools for technical analysis, automated trading through expert advisors (EAs), and real-time market data. MetaTrader is widely used by forex traders and is known for its robust features and flexibility.

Is backtesting free on MetaTrader 5?

Yes, backtesting is free on MetaTrader 5. The platform includes a built-in strategy tester that allows traders to backtest their trading strategies using historical data. However, some advanced features and tools may require additional plugins or paid services.

Can I use an MT4/MT5 demo account for backtesting?

Yes, you can do it, but the functionality is very limited. This is why many traders use backtesting software.

How to manually backtest on MetaTrader 5?

To manually backtest on MetaTrader 5, follow these steps:

- Open the MetaTrader 5 platform.

- Go to the “View” menu and select “Strategy Tester.”

- Choose the trading strategy you want to test.

- Set the parameters for the backtest, including the timeframe and currency pair.

- Click “Start” to run the backtest.

Analyze the results using the provided statistics and charts.

What is the strategy tester software for MT5?

The strategy tester in MetaTrader 5 is a tool that allows traders to test and optimize their trading strategies using historical data. It simulates market conditions and provides detailed performance reports, helping traders refine their strategies before using them in live trading.

How to Run MetaTrader on a Mac?

To run MetaTrader on a Mac, you can install software that allows Windows applications to run on MacOS. One of such solutions is Parallels Desktop. Watch this video guide if you need help with downloading and installation.

Or you can just use one of the MT5 alternatives, which are all available for Macbook.

Can I integrate my MetaTrader indicators with these platforms?

Platforms like Forex Tester Online and NakedMarkets offer options for integrating MetaTrader indicators.

Forex Tester Online supports importing custom indicators from MetaTrader if you have the source code, while NakedMarkets allows customization through C# and Visual Basic, though it currently lacks direct MetaTrader export support.

What’s the best option for traders using MetaTrader?

For MetaTrader users, Soft4FX Simulator is a good option for historical market simulation, while MetaTrader Strategy Tester works well for testing automated strategies.

What is the best alternative for backtesting without coding?

Forex Tester Online is the best choice for traders who want a powerful yet easy-to-use backtesting platform. It provides accurate market simulations, detailed historical data, and full control over trade testing—without requiring programming skills.

Forex Tester Online

Best Metatrader alternative for advanced backtesting

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska